Introduction

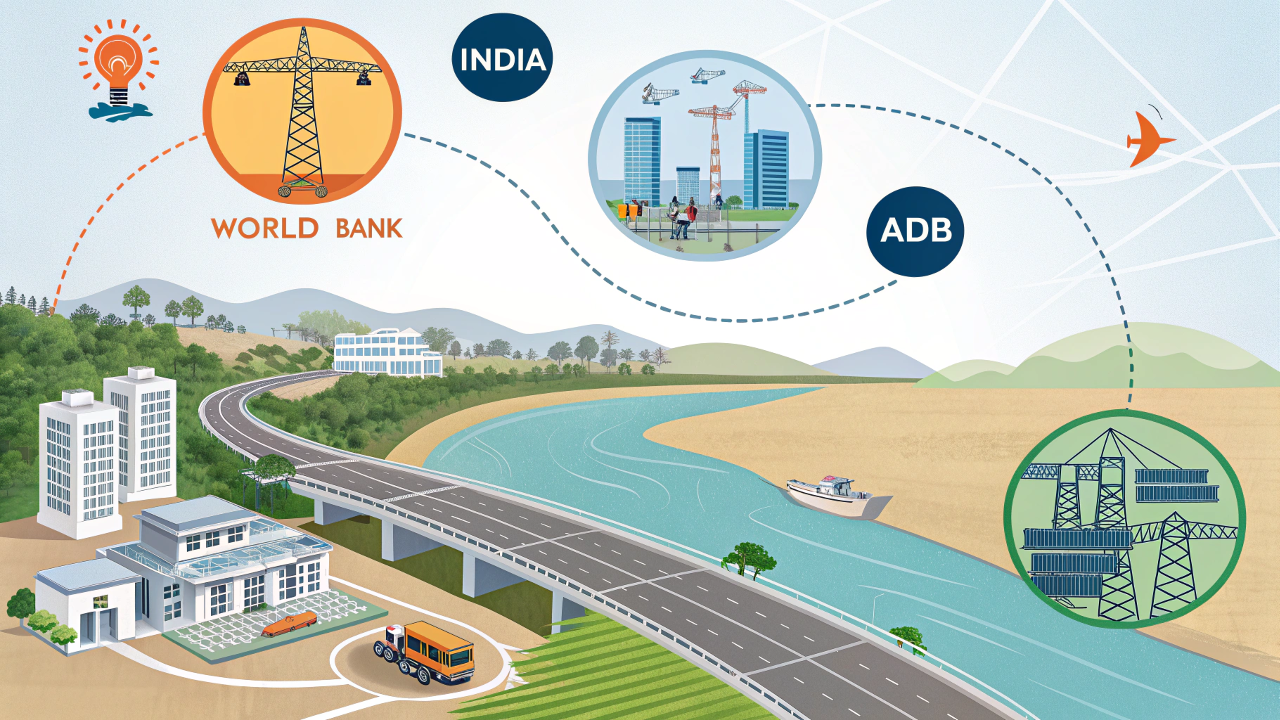

India’s infrastructure sector is undergoing a significant transformation, driven by the support of multilateral financial institutions such as the World Bank, Asian Development Bank (ADB), and Asian Infrastructure Investment Bank (AIIB). These agencies provide crucial funding, technical expertise, and policy guidance, facilitating projects in areas like transport, energy, water, urban infrastructure, and digital connectivity.

With India’s $1.4 trillion National Infrastructure Pipeline (NIP) aiming to modernize the country’s infrastructure by 2025, multilateral agencies are playing a pivotal role in ensuring financing, sustainability, and the long-term viability of these projects. This blog explores how multilateral agencies support India’s infrastructure development and the investment opportunities they create for global investors.

Why Multilateral Agencies Are Crucial for India’s Infrastructure Development

- Bridging the Infrastructure Financing Gap

- India requires $500 billion+ in infrastructure investment by 2030 (NITI Aayog, 2024).

- Multilateral agencies contribute through low-interest loans, grants, and risk guarantees, facilitating co-financing between the public and private sectors.

- Sustainable & Green Infrastructure Development

- Agencies like the ADB and World Bank focus on financing renewable energy, electric mobility, and climate-resilient projects.

- The AIIB supports initiatives such as smart cities and sustainable water management projects, helping India meet its 2070 Net-Zero carbon emission goals.

Major Multilateral Infrastructure Investments in India

- World Bank Investments in India

- The World Bank invests $6.5 billion annually in infrastructure and urban projects.

- Key projects funded by the World Bank include:

- Mumbai Urban Transport Project: $1 billion

- Rural Water Supply & Sanitation: $700 million

- Railway Electrification & Freight Corridors: $500 million

- Asian Development Bank (ADB) Infrastructure Loans

- India is the largest borrower from ADB, with a total funding of $42 billion.

- Key projects funded by ADB include:

- Metro Rail Expansion in Bengaluru & Mumbai: $2 billion

- Renewable Energy & Grid Modernization: $1.5 billion

- Rural Roads & Highway Connectivity: $1 billion

- Asian Infrastructure Investment Bank (AIIB) Financing

- India is the top beneficiary of AIIB funding, receiving $9 billion in project loans.

- Key projects supported by AIIB:

- Bangalore Metro Expansion: $335 million

- Water Supply & Urban Resilience: $400 million

Business & Investment Opportunities for Global Players

- Public-Private Partnerships (PPP) in Multilateral Projects

- Multilateral agencies often fund PPP models for infrastructure projects, offering foreign companies an opportunity to collaborate on World Bank and ADB-backed projects.

- Foreign EPC contractors are already involved in ADB-financed metro rail and road projects across India.

- Technology Providers & Smart Infrastructure Firms

- Multilateral agencies are financing projects involving AI, IoT, and smart water management systems in urban infrastructure.

- Green energy companies are benefiting from climate finance-backed projects, such as solar and wind initiatives.

- International consultants are also being engaged for project feasibility, design, and implementation.

- Risk Guarantees & Co-Financing Models

- The World Bank’s Multilateral Investment Guarantee Agency (MIGA) provides risk protection for investors.

- ADB’s co-financing with commercial banks enhances private sector participation, reducing the financial burden on investors.

Challenges & Risk Mitigation in Multilateral Infrastructure Projects

- Delays in Fund Disbursement & Project Execution

- Solution: Streamlined procurement processes and regulatory reforms to ensure faster project execution.

- Regulatory Approval Bottlenecks

- Solution: Single-window clearance systems are being introduced to simplify and accelerate approvals for multilateral-funded projects.

- PPP Revenue Risks

- Solution: Viability Gap Funding (VGF) from the government and co-financing models are helping mitigate risks associated with revenue generation in PPP projects.

Conclusion

Multilateral agencies are playing a transformative role in India’s infrastructure development. By providing billions of dollars in funding, offering risk mitigation strategies, and lending technical expertise, these agencies are facilitating the growth of India’s infrastructure sector. Their investments support sustainable growth, promote digital transformation, and unlock substantial business opportunities for global investors. As India moves forward with its ambitious infrastructure goals, multilateral partnerships will continue to shape the country’s economic progress and infrastructure landscape.

External References & Citations:

- World Bank – Infrastructure Financing in India

- Asian Development Bank (ADB) – India’s Infrastructure Investments

- Asian Infrastructure Investment Bank (AIIB) – AIIB India Project Pipeline

- Ministry of Finance, India – Multilateral Funding Reports

- NITI Aayog – Infrastructure Development & Global Investments